Good morning. Thank you, Chris, for the very kind introduction. It’s really an honor to be here in Japan.

In the United States, we have a saying that “it’s tough to make predictions, especially about the future.”

But I say that’s just because not enough Americans study Japan -- “where the future is.”

When American market participants think about our own experiences -- from the “balance sheet recessions” of Nomura’s Richard Koo, or the “quantitative easing” that Bank of Japan Governor Shirakawa warned us would not work [and it didn’t].

Or, to today’s inflation dynamics and the need to raise productivity through the use of advanced robotics -- we in the West are always thinking about “the Japan experience” to help chart our own future.

West are always thinking about “the Japan experience” to help chart our own future.

So, let me begin by offering a grateful “thank you” from the United States! Our futures, East and West, are tied together.

I’m going to make some points about the future, and then try to illustrate them in a series of images -- often the best way to impart ideas.

My main point is the future is about Re-regionalization -- a world of competing blocs, where national security concerns are the structural driver of markets -- and not the central bank.

I introduced Re-regionalization into the discourse back in 2019, and to illustrate it, I always use an image from architecture.

On the left, you see Le Corbusier’s Maison Domino from 1914, and on the right, Rem Koolhaas’ sketch from 1995.

That transition, from Corbusier to Rem, is the market’s future.

To make this case for Re-regionalization, we must first review the two chief cornerstones guiding every market participant -- the security outlook and the policy responses.

We will then discuss some of the implications for liquid markets and, since most of you are long-term investors, conclude with a few examples of the most compelling investment opportunities on the horizon.

First, let’s be clear about the security outlook, particularly after the Hamas-led terrorist attacks on Israel:

Market participants will now have to operate in a protracted conflict environment.

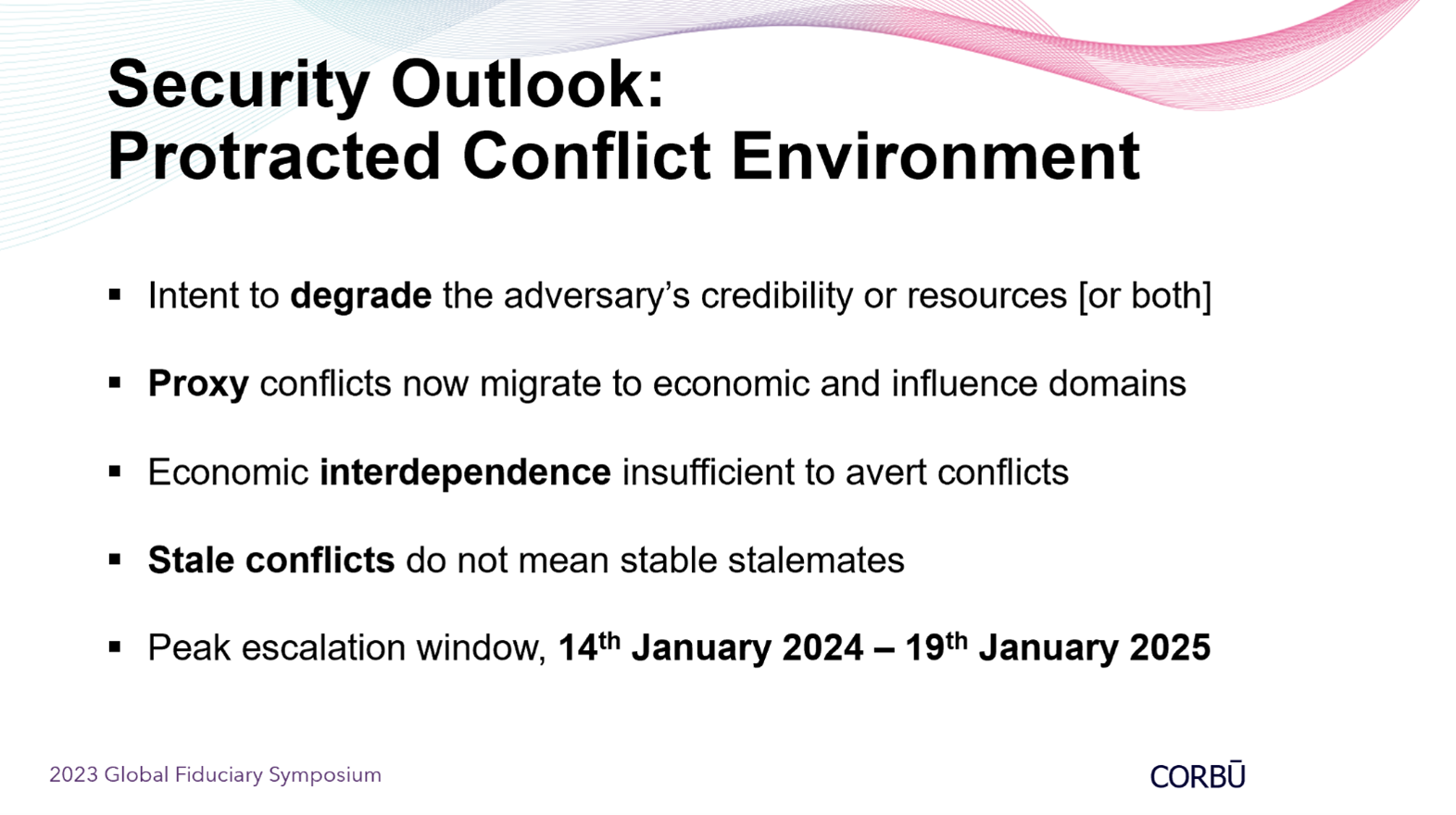

There are five key points to make about this security picture.

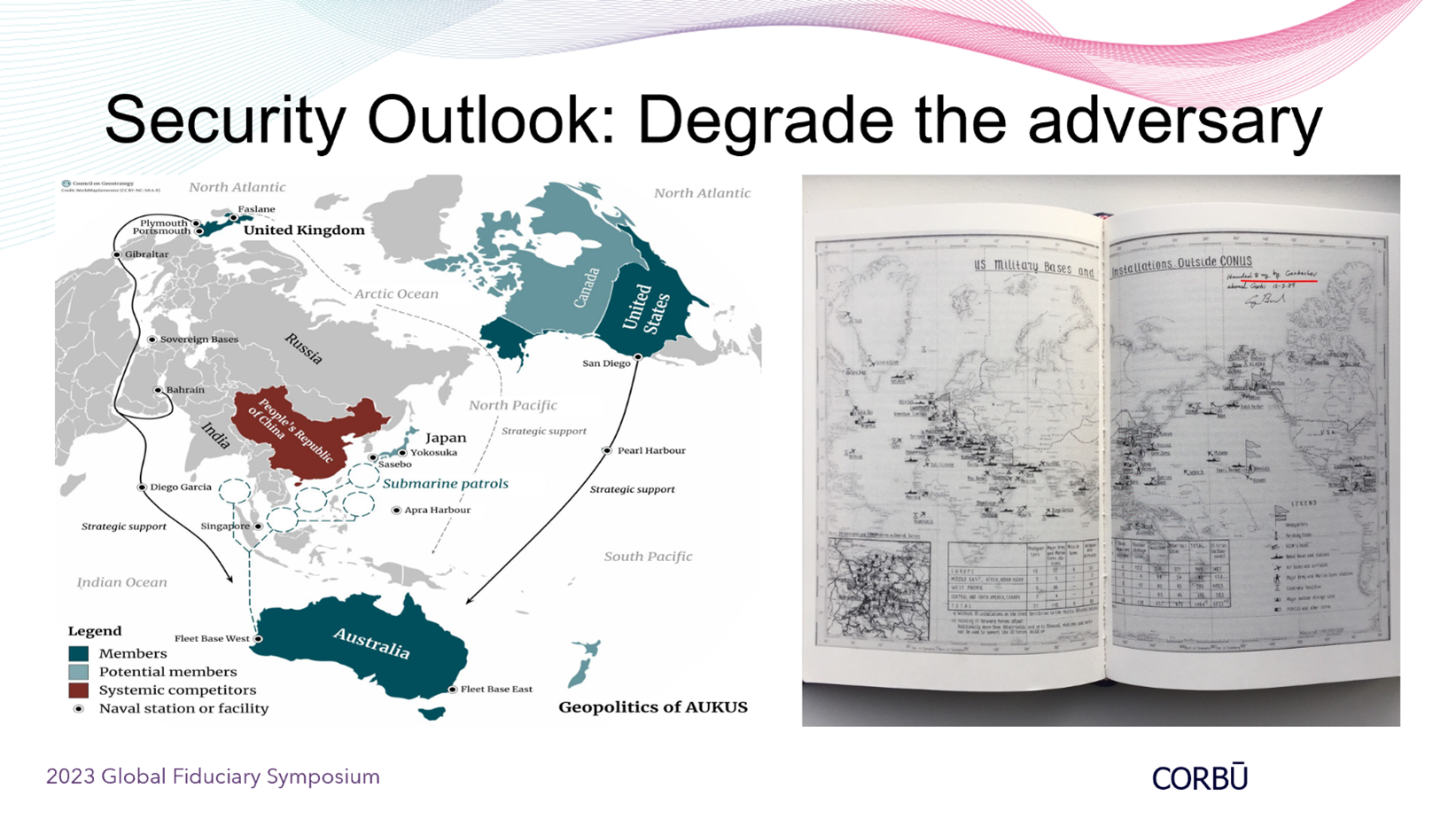

#1: Whether it is the US-led NATO+ alliance, or the Beijing-Moscow-led bloc, rather than engage in direct conflict, the strategy is to over time degrade both the credibility and resources of the opposing bloc.

Which segues to point #2: with direct military confrontation off the table for now -- the bloc confrontation migrates to proxy conflicts -- particularly in the influence and economic domains.

These “economic proxy wars” prove point #3 -- that economic interdependence is totally insufficient to avert conflict.

This is also one of the major lessons from Putin’s war in Ukraine -- and serves as a word of caution to both policymakers and market participants alike, especially here in Asia -- that “stale conflicts” are not the same thing as “stable stalemates.”

Which speaks to the 5th and final point: that there is a critical window when “stale conflicts” pose maximum risk to the global security outlook.

That window opens next year on January 14th, the day after Taiwan’s presidential election, and runs through January 19th of 2025, the day before the US inaugurates its next President.

A few images to illustrate these points.

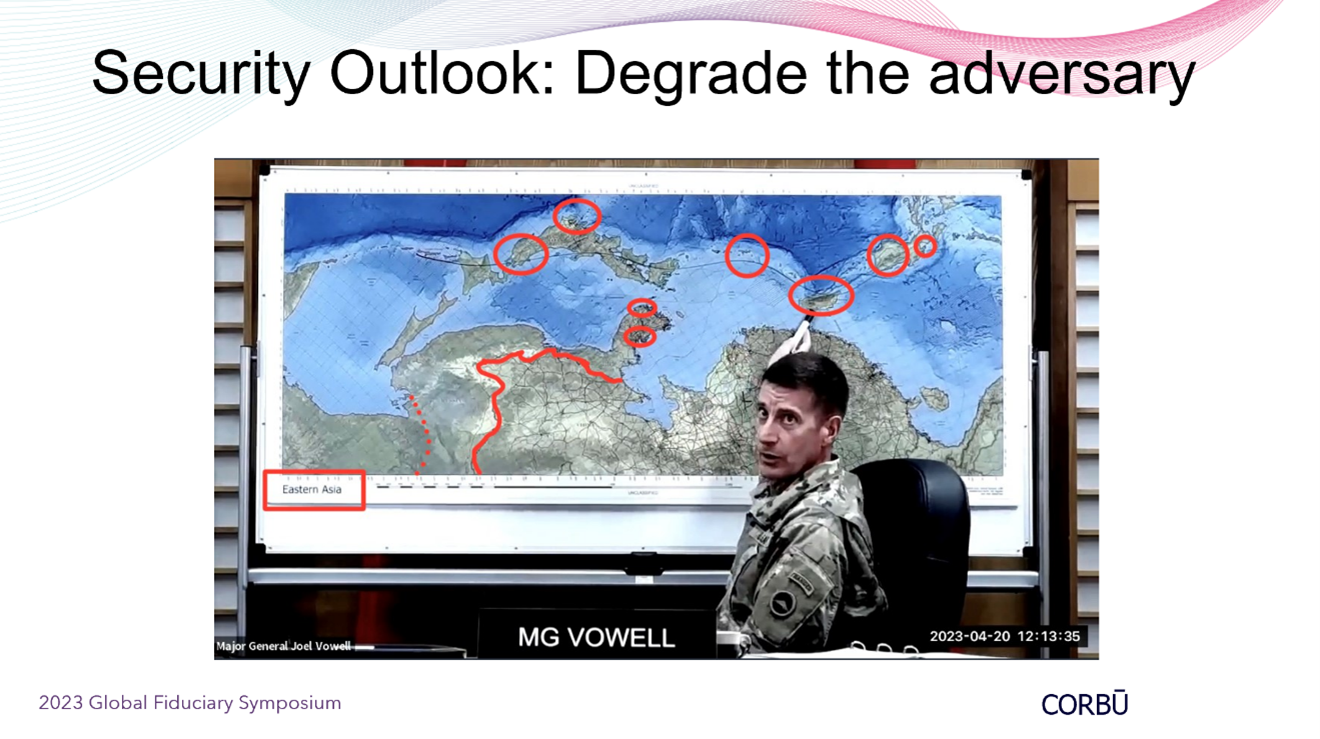

This is maybe the most important one, a screenshot from a briefing with Major General “JB” Vowell, the commander of US Army Japan.

The red circles are large US military installations; the solid red line is the border with Russia and DPRK; and the dotted red line is the territory that China lost to Russia in 1860 -- which also cut off Chinese trade access to the Sea of Japan.

This image makes clear that the top national security risk to Xi Jinping’s China is not really “separatist DPP independence forces” in Taiwan -- but instead Vladimir Putin falling from power and a pro-Western government installed in Moscow.

When Xi Jinping claimed earlier this year that the United States’ intent is to “contain, encircle, and suppress” China -- he probably feels much like Soviet leader Mikhail Gorbachev did in 1989, especially after the AUKUS nuclear submarine agreement.

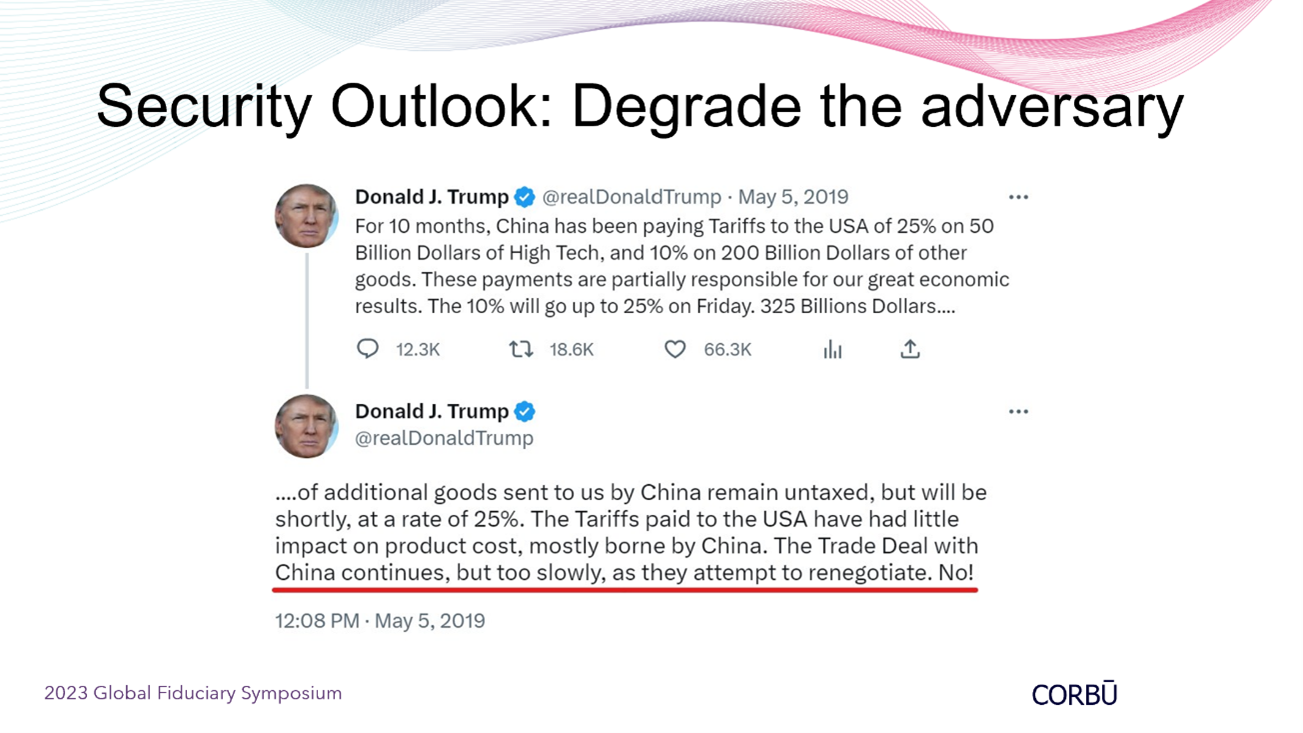

Or after the traumatic Trump experience, when the Phase One trade deal negotiations fell apart -- and the President aggressively escalated the tariffs back on May 5th 2019.

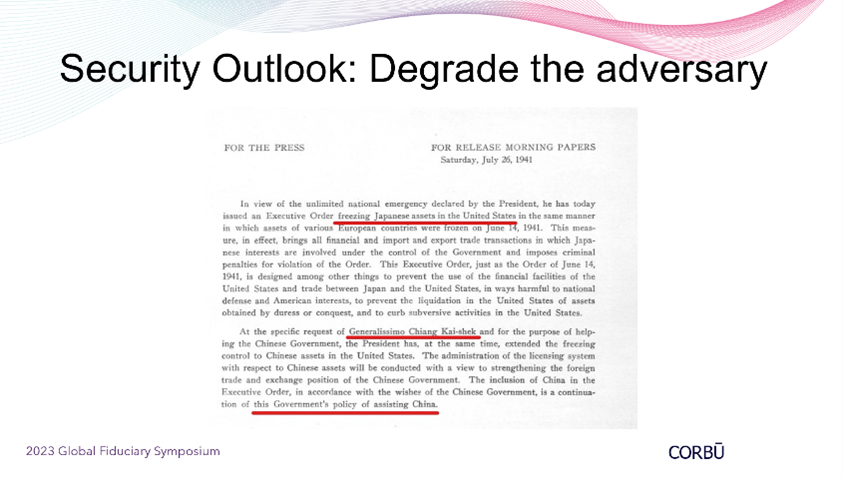

I will posit that all these collective measures, at least in Beijing’s view, are not that different from President Roosevelt’s oil embargo in 1941.

Now to be clear, this strategy to degrade the adversary over the long-run -- runs in both directions -- with three landmark geopolitical events to highlight.

This is an historic image, Xi Jinping’s state visit to Moscow in March, when Putin announced the proliferation of nuclear weapons to 3rd countries.

A couple months later, Xi Jinping then convened a meeting of the Central National Security Commission, instructing cadres to prepare for “extreme circumstances and worst-case scenarios.”

Which culminated a few weeks ago at the 3rd Belt and Road Forum in Beijing, where President Xi felt compelled to meet “privately” with President Putin -- and without any staff present -- to discuss “very confidential issues.”

Over the next several months, we shall see exactly where and how those “confidential issues” materialize.

But in the meantime, the “geopolitical competition” is already operating in the proxy spaces -- of financial markets and the influence domain.

Start back in 2014, here’s a presentation slide made by head of the Russian General Staff, Valery Gerasimov, which articulated the “new approach” to achieving politico-military goals.

It’s continued, as seen in the Pentagon “Discord leaks” earlier this year, which highlights GlavNIVT, one of Russia’s operations to dominate the information space through social media.

Setting the scene on the economic proxy front, here are the pre-pandemic Chinese trade linkages relative to the US and Germany.

Fast forward to 24th February 2022, on the very day when Putin invaded Ukraine -- here’s Ali Shamkhani, then-Secretary of the Supreme National Security Council of Iran, predicting an energy crisis in Europe and as a doctrine of warfare.

Just 15 months later, Europe’s High Representative, Josep Borrell, announced one of the most stunning facts of the century during a speech at the Shangri-La Dialogue:

While Europe’s total direct support of Ukraine was €60B -- the total indirect cost of the war to Europe, in higher energy and food prices, was €700B -- more than 10 times higher.

Which segues to maybe the most contested counterfactual of the last 18 months:

If Putin had not invaded Ukraine… and had US headline inflation not approached +10% -- does anyone in this room believe the Federal Reserve would still have hiked interest rates by +75bps, 4 times in a row?

Would the NASDAQ still have fallen by -33% last year?

Or would the global banking crises across Switzerland and the US still have materialized this spring?

Everyone serious knows the answer is a resounding no.

The reality is that geopolitical conflicts now matter a great deal for markets.

And proves once again the lesson from 1911 -- that economic interdependence is insufficient to avert conflict -- and is sometimes even a catalyst for conflict.

For example, here’s the forecast for Russian gas export revenues -- set to peak in 2022 -- unsurprisingly, the same year Putin chose to prosecute his war against Ukraine.

Or the almost 100bcm of Russian gas pipelines to China once the Power of Siberia II project is complete -- a nearly 1:1 offset to Russia’s NordStream I and II pipeline complex in Germany.

This all serves as a note of caution that “stale conflicts” are what we call in the economics literature, “unstable equilibria.”

With the developments in far-flung parts of the world like the Levant -- now migrating and potentially spilling over into the Korean Peninsula…

…Or the strained regional environment -- see these survey results from the Tsinghua Center for International Security and Strategy, which show mainland Chinese holding the most unfavorable views towards Japan and the United States.

This brings us to what’s often left unsaid -- the “big elephant in the room” weighing over both markets and policymakers:

The heightened risk of a cross-Strait contingency, sometime next year after the Taiwan elections.

While I will not go over this in detail, I will just tell you that both sides of the Strait are preparing for such a scenario.

This is again from the latest Pentagon “Discord leaks,” showing the latest China PLA supersonic drone capabilities over the Island and the Peninsula.

This is a wargame that US Strategic Command conducted earlier this year -- and I encourage all of you as market participants to use this “tabletop exercise” as an initial framework for your own scenario planning.

Given this admittedly challenging security outlook -- we now come to the policy response.

In March of 2020, during the throes of the Trump Administration’s erratic pandemic policy response, I somewhat infamously told our clients that:

“The event itself is never the shock -- the shock is always the policy response.”

While there have been exogenous shocks to the security environment, I’ll argue that the policy responses have transmitted either equivalent or greater shocks to global markets.

Led by the US Biden Administration, the Western policy framework now follows a three-pillared approach -- and the following is extremely important for all market participants to understand, so please pay attention:

Pillar #1: Conduct “exhaustive diplomacy,” by first bolstering the alliance network.

For example, with the enlargement of NATO in Europe; or here in Asia, with the Washington Declaration, the Camp David Trilateral Summit, and the new Japan-Philippines OSA defense transfers.

With the Alliance’s borders now clearly redefined, Pillar #2 is what I call, “Sanctuarization Doctrine” -- or the practice of horizontal escalation management -- which credibly ensures that any conflicts stop on the front lines of the Alliance.

The 3rd and final Pillar is economic deterrence, where rather than engaging in direct military hostilities -- Western policymakers instead institute a new worldwide controls regime on capital and exports of sensitive dual-use items.

This policy pillar fundamentally impairs the economic capacity of the adversary and establishes a lower ceiling on its long-term growth prospects.

A few quick images to illustrate these policy shocks.

First, this image of then-Vice President Biden with then-Vice President Xi in Chengdu in 2011, is as they say, “worth a thousand words.”

March 1st 2022 -- a line outside of an ATM machine at a McDonalds restaurant in Moscow -- the day after the policy shock “heard ‘round world,” when Russia was removed from SWIFT and its central bank reserves frozen.

The silent trade war between China and Europe -- with Chinese auto exports now overtaking Germany -- is arguably the main reason for recent European security alignment with the US in the approach vs Beijing.

Everyone here knows the Western policy of de-coupling would disproportionately impact emerging market economies in the Indo-Pacific.

But the risk around this potential policy shock has resulted in non-Western countries pursuing their own de-coupling policies.

For example, developing the Northern Sea Route -- one that would reduce shipping times from Europe to Asia from 36 days down to 15 days.

Or Russia’s efforts to mitigate the effects of climate change, by expanding its arable land -- and becoming the global agricultural superpower.

This Eastern policy of establishing new global maritime trade routes necessarily requires building out a new security infrastructure.

For example, with Russia’s militarization of the Arctic Ocean -- which I’ll add has tremendous implications for Japanese energy security.

Now everyone here knows of Beijing’s port infrastructure buildout across the Indo-Pacific.

But probably fewer of you know it’s also migrated to the Atlantic Ocean via China’s Project 141 -- and much to the alarm of the US Dept of Defense.

Ultimately, the main takeaway from the global policy mix is to borrow a concept from Angel Ubide’s book, “The Paradox of Risk” -- that the risk of inaction is oftentimes more risky than the risk of taking action.

This Risk Paradox insight was fundamental to the success of “Abenomics” -- and is a great segue to the market implications and investment opportunities arising from this Re-regionalized landscape.

At this point, I know some of you might feel sobered into risk aversion given the strategic environment in which you must operate.

But don’t be.

Instead, I hope you’re excited.

Excited because the risks I laid out this morning also present once-in-a-generation investment opportunities.

Opportunities that will produce spectacular returns in the years ahead.

It’s just going to take some hard work and strong conviction.

First, a few implications for liquid markets:

It’s clear that we are in a period of structurally higher volatility, higher inflation, and higher levels of neutral interest rates.

This environment benefits assets, across the capital stack, that are denominated in US dollars or other reserve currency issuers, like the yen and euro.

These capital inflows to reserve currencies will come mostly at the expense of capital outflows from the EM countries that were the former “arbitrage hubs” in the pre-pandemic global supply chain.

Which means asset allocators, especially in the West, will demand Asia, ex-China exposures.

And given the scale of the capital flows and the market cap capable of absorbing them -- it’s destinations like Japan and Korea that will be the primary beneficiaries.

Ultimately, this geopolitics-driven environment is forcing a global capex supercycle that will, over time, raise productivity in the industrial and manufacturing sectors across the developed world.

Again, some images to quickly illustrate these themes.

Setting the context, one of my favorites from the Bank of England: the average global inflation rate over the last 700 years -- about +1.5%.

And on a side note, this chart tells me that BOJ Governors Fukui and Hayami were right!

Or at least they were more right than Federal Reserve Chairs Bernanke and Yellen.

The failure of the Fed’s 2% inflation target is not just conjecture -- there’s proof.

This is from one of Larry Ball’s papers for the Brookings Institution, where he estimates the pass-through to US core inflation, from headline energy shocks alone, is a cumulative 2%!

Which means the new trend inflation going forward is probably closer to 3-4%.

Given the unblemished track record of oil price shocks as the precursor to recessions, it’s understandable why the “soft-landing” narrative waxes and wanes.

That said, the historical correlation of oil prices and recessions has recently broken down -- offset by the resilience of USD-denominated assets -- and the large divergence of US valuations from the rest of the world.

It’s here where I’ll reiterate the tremendous opportunity for mature and sophisticated markets like Japan -- to take permanent market share in the international financial system.

The +25% outperformance spread between Japanese vs Chinese equity markets this year -- catalyzed by major geopolitical events such as the 20th Party Congress or Xi’s state visit to Moscow -- is telling.

Capital is voting with its feet.

The multi-trillion dollar question then becomes: will all this security-driven, arguably wartime capex, result in higher productivity?

If you answer in the affirmative, then market participants must expect mean reversion -- to a higher level of neutral interest rates -- somewhere closer to the +5% level of the last 700 years.

And I will argue that, especially for the United States, this is existential -- US real rates and productivity must rise.

Otherwise, as this chart makes clear -- when inflation episodes exceed 10%, then the privilege of issuing the reserve currency ends. And the empire ends, too.

Given that liquid markets outlook, will conclude by highlighting just a few investment opportunities in the more illiquid space -- where many of you in this audience excel.

I call it “time arbitrage.”

Best illustrated in Picasso’s bulls, where “the space between” the abstraction on the right and the master draughtsman’s rendering on the left -- is metaphorically “where the risk premium lies.”

For market participants with a longer-run mandate, it’s the ideal place to be.

But first, set the scene with a little test that I always conduct with fellow market participants.

This is an image I took during a defense sector technology conference I attended back in 2021 -- and here’s the question:

Which of those 3 objects scare you the most: the burly man on the left, the German shepherd in the middle, or the robotic dog on the right?

It’s a trick question -- because the correct answer is when all 3 of them are working together as one.

While this sort of “human machine teaming” and “dual-use” technology has sparked another “revolution in military affairs” -- the far more important point to remember is that the advances in the defense sector will flow downstream -- and totally revolutionize the industrial and manufacturing sectors across developed economies.

For some clues on where to point your focus, this is from US Special Operations Command in Tampa, Florida.

If you ask SOCOM what they need, they’ll tell you that “all the Pentagon’s military problems would disappear” if they could just solve the following four things: sensors, compute, comms, and energy.

Clearly, the same could be said for any firm in the $50T global industrials and manufacturing sector.

Enter as a solution, what I’ll call “The New Holy Trinity of Digital Technology” -- graphics processing units; foundational large language models; and the new materials science of bioengineering.

Companies who are simultaneously leveraging all three of these corners in the Digital Trinity are what will truly usher us into the “Fifth Industrial Revolution.”

Some examples.

Digital twins: this is BMW, who is building its next auto manufacturing facility in Hungary [not in China by the way] -- and designed completely in NVIDIA’s “Omniverse,” a digital 3D simulation platform that allows BMW to eliminate any waste throughout the building process, and then continuously optimize factory workflows in real-time.

Another example: large language model-driven robotics.

This is the Robonaut from NASA in Houston, Texas, where a partnership with General Motors is developing a robot with zero-gravity dexterity exceeding that of humans.

Will also note that for automakers like Ford, the robotic arms are relatively inexpensive, costing around ~$25,000. But it’s the cost of programming those robotic arms which are expensive, almost $250,000.

However, now with the application of large language models to the programming process -- over time, that robotic arm will program itself.

And this is for all of you value investors out there -- that $250,000 of programming costs, will soon drop straight to Ford’s bottom line -- in higher profits.

Another opportunity incumbent upon me to highlight [which I won’t spend much time on, though we can discuss it on the sidelines of this Symposium] is brain computer interfaces.

Which segues to what I’ll tell you is the single most compelling investment opportunity space of the next 30 years -- and if you don’t remember anything else I said this morning, remember this:

The bioeconomy and molecular manipulation.

This briefing I attended from the US Dept of Defense’s Biotechnology division forever changed my investment outlook.

With the introduction of molecular manipulation, we now have the ability to bioengineer any element in the periodic table.

However, it’s currently limited by two factors: doing it economically and doing it at scale.

Which is the exact same problem the semiconductor industry faced in the 1970s -- and now we have over a trillion transistors on a single chip.

This isn’t just a “decades out” theme -- this transformation is underway today.

Look at John Deere, who in 2017 embarked on a machine learning, AI-driven capex cycle -- that transformed a boring one-time seller of manufacturing equipment -- into a subscription-based technology platform for agriculture.

And most importantly, raised Deere’s multiple from 8 times to over 20 times.

Also note that the market cap of John Deere now exceeds that of Lockheed Martin, the largest global defense prime.

I know we’ve covered a lot in this “tour de horizon.”

But I think there’s no more important topic for fiduciaries and global investors to understand than the Re-regionalization framework.

Hopefully this briefing will guide your discussions throughout the rest of the Symposium.

And I’m always happy to chat 1:1 or send you these slides along with the prepared remarks.

I’ll be around all of today and tomorrow, just come grab me.

Let me end my presentation as I always do -- with the following two quotes worth reflection.

The first is worth reading verbatim.

From Rem Koolhaas, presciently back in 1995:

“The next round of East-West tension will be fought over this question:

whether democracy promotes or erodes social stability; whether free speech is worth the cultural trash it also produces; and whether the health of a collective matters more than the unfettered freedom of the individual.”

So we’ll close where we started -- with architecture -- and the great Kenzo Tange, right here in Tokyo.

Because when you think about it, there is maybe no better instantiation of Re-regionalization -- than St Mary’s Cathedral.

Sacred space.

Thank you.

.png?width=545&height=273&name=2024%20US%20Election%20Longitudinal%20Survey%20(5).png)